Update: A new tool to help Kentuckians understand benefits cliffs

Last year, I wrote about the entanglement between earned income and work supports provided through public assistance programs. As the costs of basic needs have skyrocketed during this period of rapid inflation, it is worth revisiting the impact of cliff effects on workers in low-wage jobs. The Kentucky Center for Statistics has revamped its Family Resource Simulator, making it easier to use and ensuring it will stay updated and relevant in a changing economy.

Workers in low-wage jobs often do not earn enough to make ends meet. As a result, many workers in low-wage jobs rely on public assistance programs to cover the costs of living. These work supports are an important resource for workers in low-wage jobs, helping them afford food, stable housing, healthcare, and childcare.

The need for these work supports can lead to tensions in the labor market. Low-wage workers often face trade-offs as they pursue career advancement, because earning more in income can mean losing access to public assistance programs. These cliff effects might prevent workers in low-wage jobs from taking advantage of career advancement because of a very rational decision-- they would ultimately have fewer resources to provide for their family.

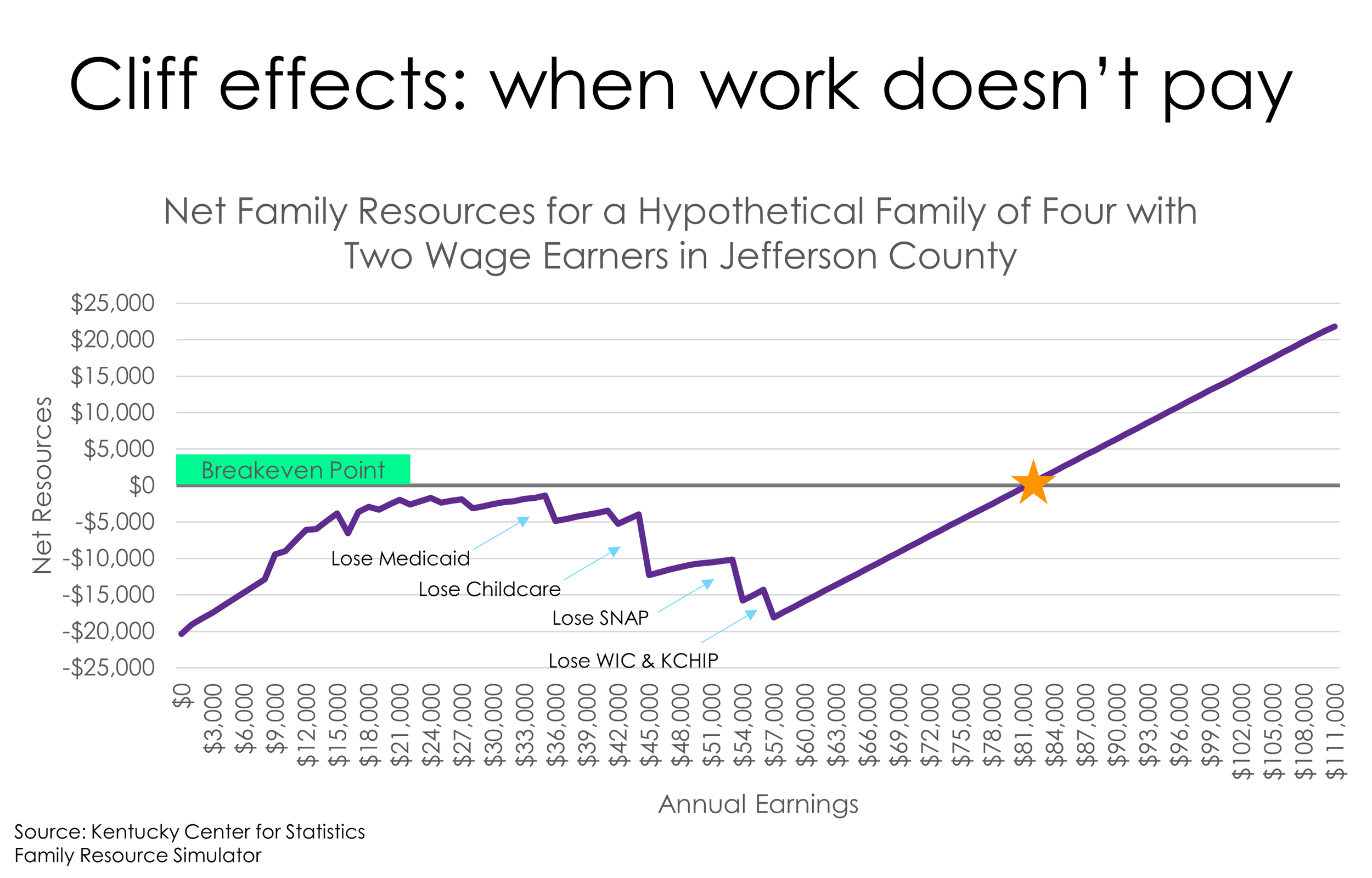

The Kentucky Center for Statistics has developed a tool that shows the net results workers face when they earn more but become ineligible for work supports in the process. The Family Resource Simulator shows net resources – earned income plus work supports, minus expenses plus taxes. It has been updated, and will be maintained by the state so that it can be regularly updated. This will enable the tool to stay relevant in the context of increasing costs and any changes in policies that would impact access to public assistance programs. The revamped tool also makes it easier to see which work supports are lost at which level of earnings, and to determine what a self-sufficient wage would be for a family to live without the use of public assistance programs, and without facing housing or food insecurity.

For example, for a hypothetical family of four living in Jefferson County with two full-time working adults and two young children, the Family Resource Simulator shows the family would need to have a combined income of at least $82,000 per year to finally make it to a breakeven point where they are earning enough to cover the costs of basic needs. Split evenly between the two parents, that’s nearly $20 per hour for each. Notably, this breakeven point does not account for life’s curveballs, like car repairs or an unexpected medical bill. At earnings less than this threshold, the family cannot even cover the basics, despite the use of work supports. In addition, the family faces many cliff effects, where a small increase in earnings makes the family worse off.

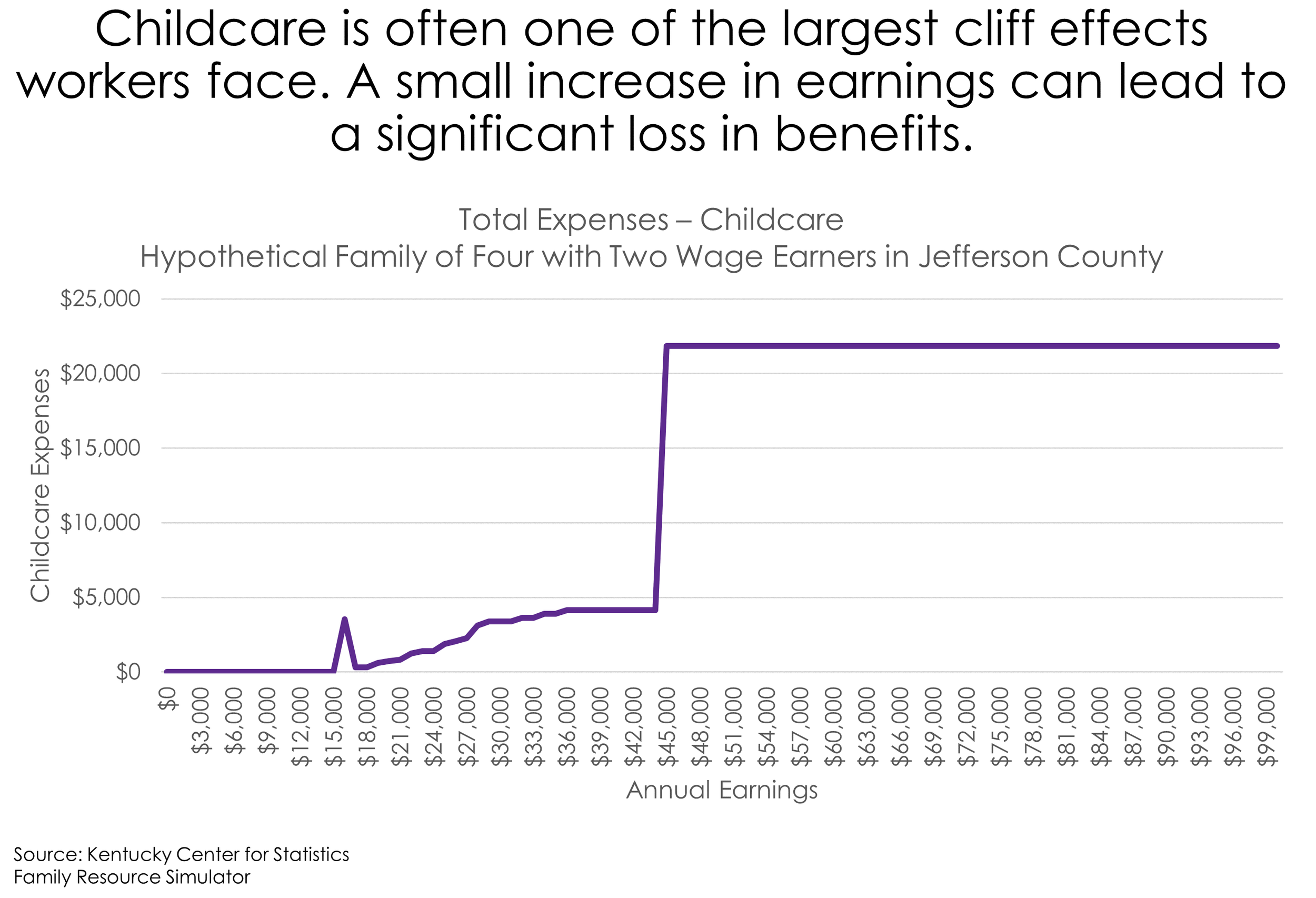

One of the largest cliff effects this family faces is the loss of child care assistance, where a $1,000 increase in the family’s earnings results in an increase of nearly $18,000 in child care costs.

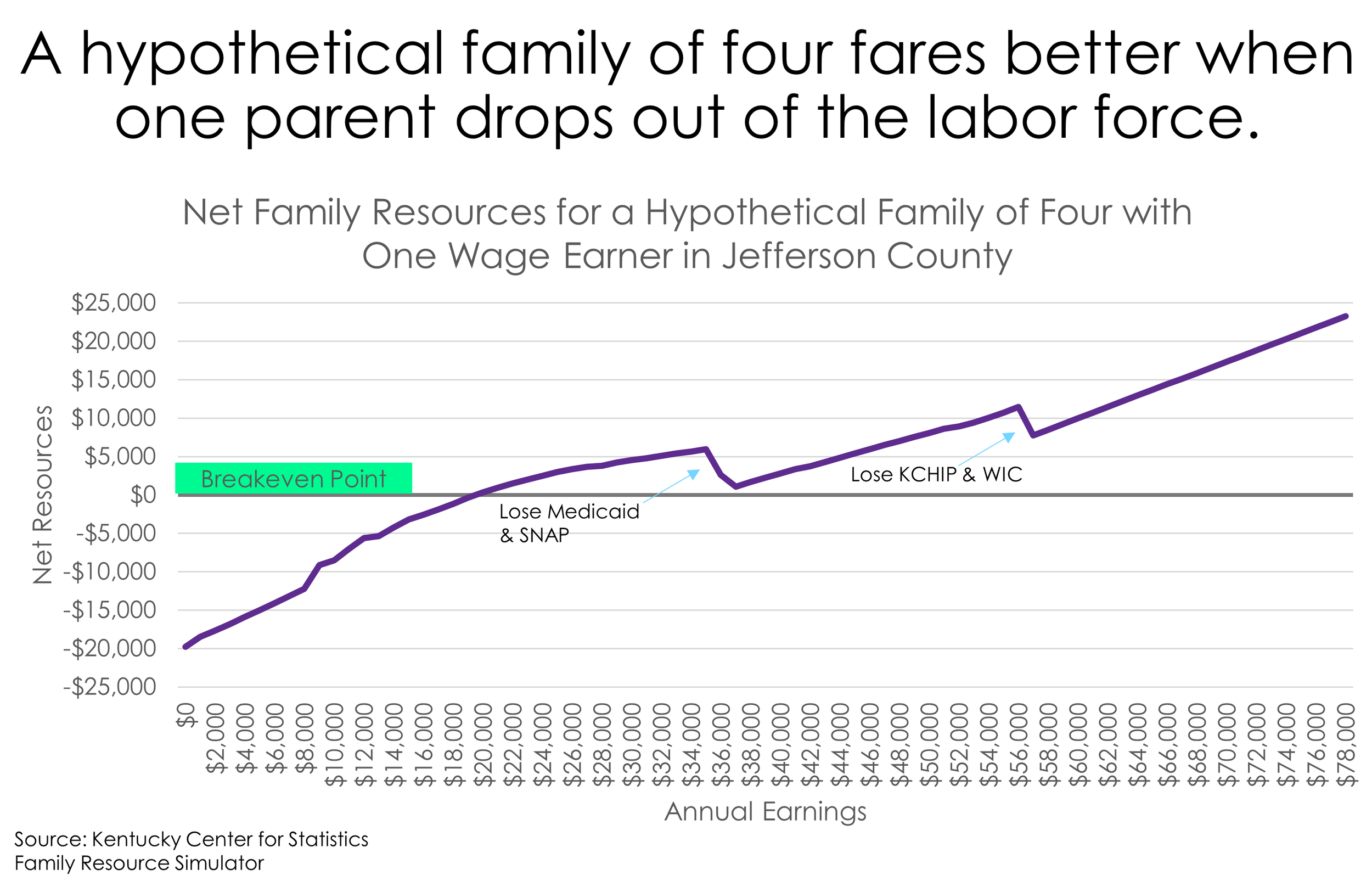

We can modify the Family Resource Simulator to show how this hypothetical family of four would fare if there were only one wage earner, and one adult did not work, therefore covering the costs of child care through the unpaid labor of one parent. It is perhaps not surprising, although very discouraging, that the family is altogether better off when one parent drops out of the labor force. Although the family still faces cliff effects, they reach a positive breakeven point at much lower earnings without paying for child care. Even so, the one wage earner would need to make more than $30 per hour to maintain the same level of net resources as provided with access to work supports.

The role of child care in the labor force participation rate among women was a problem heightened in the wake of the COVID-19 recession. As the Commonwealth continues to grapple with a labor shortage, the Family Resource Simulator helps shed light on the trade-offs workers, and potential workers, face in labor force participation and career advancement.